Any idea what's going on with La Couronne du Comte?

-

Forum Statistics

354.4k

Total Topics4.6m

Total Posts -

Member Statistics

127,329

Total Members2,585

Most OnlineNewest Member

MyQuill

Joined -

Images

-

Albums

-

Extra Fine Nib Ink Reviews (19 of n)

- By LizEF,

- 0

- 16

- 16

-

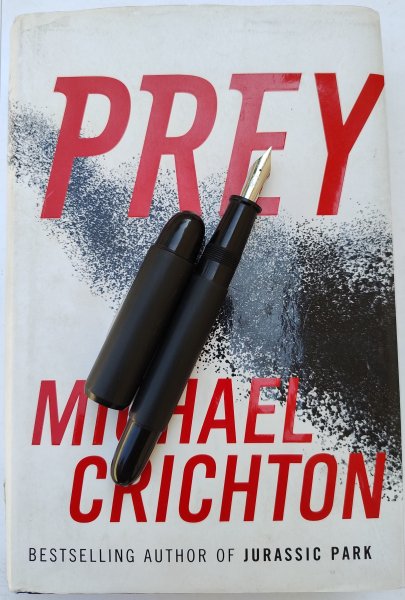

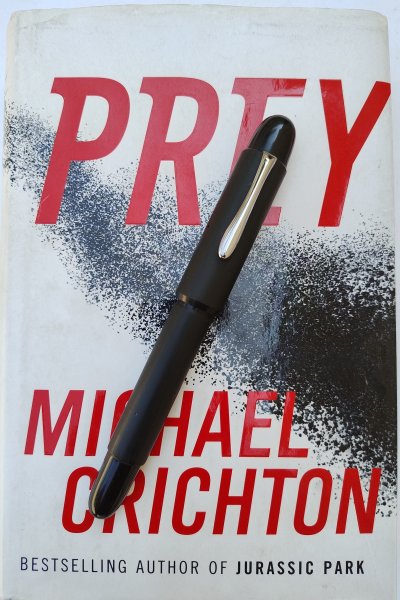

Pen Pics 2

- By K Singh,

- 0

- 0

- 83

-

Dan Carmell

- By Dan Carmell,

- 0

- 1

- 84

-

4posts

- By Tashi_Tsering,

- 0

- 0

- 43

-

First look

- By A Smug Dill,

- 3

- 42

-

.thumb.jpg.f07fa8de82f3c2bce9737ae64fbca314.jpg)

.thumb.jpg.331e554113c33fb39d5bf3233878978a.jpg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now